In 2013, American student debt hit the $1 trillion mark. The financial equivalent? Purchasing over 175 billion Big Mac meals, 3.3 billion iPhone 5s or 3.6 million average American homes.

The picture of student debt is not a pretty one.

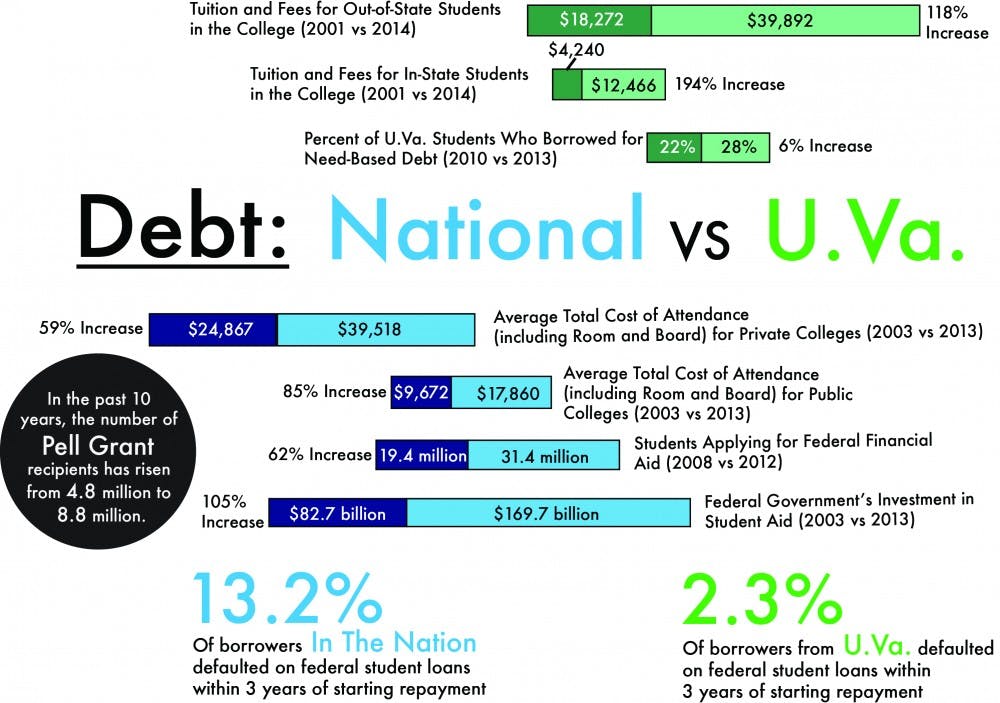

By most indicators, these numbers will only continue to rise. The number of students applying for federal financial aid — which is the largest contributor to student debt — has risen 62 percent in five years, according to data from the U.S. Department of Education. About 31.4 million students applied for federal aid for the 2011-12 year.

Though University financial services and low rates of delinquency place University students in a sounder position than many of their national counterparts, increasing costs of college education across the board make one thing clear: American students, sooner or later, will have to pay.

Why the rise?

Increased demand for higher education financial assistance is attributed both to the recent recession and the rising cost of college. According to the 2012 “College Board Trends in College Pricing” report, the average total cost of attendance — including tuition, fees and room and board — at a four-year private college increased 59 percent between 2002-03 and 2012. The same increase is reflected in four-year public colleges, whose average costs increased from $9,672 to $17,860 during this period.

University tuition increases are consistent with these nationwide trends. Out-of-state students, who paid $18,272 in tuition and fees for the 2000-01 academic year, now pay $39,892. The increase percentages are similar for in-state students.

The federal program

To accommodate the growing necessity, the federal government — along with a decreasing number of private sources — has increased funding to those who demonstrate need. The application for federal assistance, the Free Application for Federal Student Aid, collects demographic, income and asset information from applicants and their families and utilizes this information to estimate the amount students and their families are expected to contribute to college. The Expected Family Contribution is determined by a formula established in Title IV of the Higher Education Act.

The Federal Student Aid Program offers assistance in the form of federal Pell grants, federal supplemental educational opportunity grants, federal work-study, federal Perkins loans, direct subsidized Stafford loans, direct unsubsidized Stafford loans and direct PLUS Loans. To meet intensified need, the federal government has increased the number of Pell grant recipients from 4.8 million to 8.8 million in the past decade, and has increased funding distributed through other programs by 105 percent overall. At present, the government offers roughly 61 percent of its financial assistance in the form of federal student loans.

Though federal aid is on the rise, loans within the private sector are in decline. Private sector loans represented only 2.6 percent of all aid between 2011 and 2012.

University trends

With more and more students requiring financial assistance to pay for college, the student debt situation is only set to worsen — though, so far, the University has stayed ahead of national trends.

“In 2009-10, the average need-based debt of a U.Va. student who graduated … after four years was $10,074,” University spokesperson McGregor McCance said in an email, combining federal, state and private loans awarded through the University to tabulate debt statistics. “The average of all student debt was $19,253. In 2012-13, the average need-based debt of a U.Va. student who graduated … after four years was $12,447. The average of all student debt was $21,815.”

U.S. News & World Report reported $29,400 in average student loan debt for the class of 2012.

According to an analysis by the independently run Project on Student Debt, though, 36 percent of the University’s class of 2012 graduated in the red, with 82 percent of that debt coming from federal sources.

In regard to dealing with debt, University President Teresa Sullivan said the University is ahead of the curve on two main fronts: financial literacy services and capping debt overall.

“[Despite AccessUVa changes], there is still a cap on indebtedness, which a lot of schools don’t have,” Sullivan said in a student media meeting. “What it does is make it more predictable for students on how much indebtedness they’ll take in.”

Fighting delinquency

While the initial accumulation of debt may pose a frightening reality for many University students, the biggest challenge — paying it back — is often still to come. According to a study by the Federal Reserve Bank of New York, about 17 percent of borrowers were past due on their student debt by more than 90 days in 2012. Students late on repaying their loans see their tardiness reflected in their credit ratings — which only compounds problems down the line.

University students, however, typically have low rates of delinquency. According to College Scorecard, which uses data collected by the Department of Education to compare average net price, graduation rates, loan default rates and median monthly borrowing by students, an average 13.4 percent of borrowers default on federal student loans within three years of starting repayment. The University’s average default rate, meanwhile, is only 2.3 percent — among the lowest of its peers.

Sullivan noted, however, students can get themselves in trouble by amassing debt from other sources.

“Beyond your financial aid package, it’s possible for students to use a credit cards, or do other things to get themselves deeper into debt that we’re not always aware of,” Sullivan said. “At Texas, … I taught a freshman seminar called ‘Credit Cards, Debt and American Society.’ And what was really … enlightening to me is parents would much rather talk with their kids about sex than they would about money. That’s one of the reasons that financial literacy is so important.”