Universities’ endowments decreased nationwide by 0.3 percent from 2011-2012 according to a study released Friday, marking the third time in the last five years average endowments have declined. By contrast, the University’s endowment increased by 0.6 percent in that period, with long-term investments returning 5.1 percent.

The National Association of College and University Business Officers, a higher education advocacy group, partnered with Commonfund, a nonprofit economic viability adviser, to review endowment information from 831 colleges and universities, both public and private, to produce the study.

NACUBO President and CEO John Walda and Commonfund Executive Director John Griswold said in a joint statement the data showed universities with the largest endowments had the highest investment returns. The University’s endowment, totaling $5.43 billion, ranked 19th largest of those surveyed.

“We attribute this outperformance [of universities with large endowments] to a number of factors: well diversified portfolios, … access to top-tier investment managers and greater resources, including larger staffs, leading-edge technology and experienced investment committees,” Walda and Griswold said in the statement.

While many donors restrict the use of their endowment contributions to specific scholarships and professorships, 32 percent of the University’s endowment is unrestricted. These unrestricted funds are used to support AccessUVa, the University’s need-based financial aid program, and other Board of Visitors initiatives University spokesperson McGregor McCance said in an email.

“The Board of Visitors determines the level of endowment spending in any given year, ranging between 4 percent and 6 percent of assets,” McCance said.

McCance said University President Teresa Sullivan supported finding money to raise faculty salaries and has not dismissed the option of finding some of that money by further drawing on endowment funds.

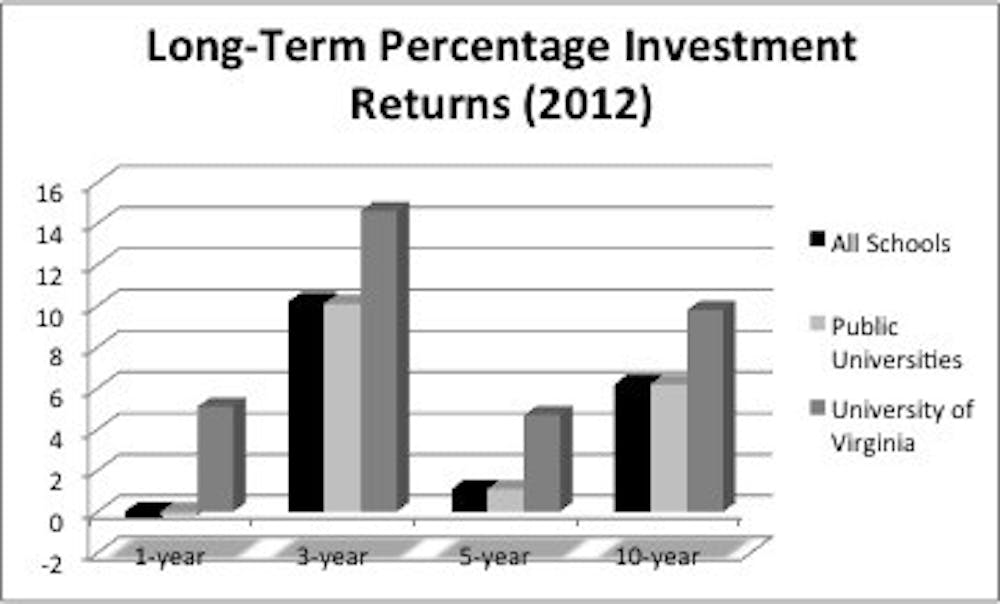

The University beat three-, five- and 10-year averages for university investment returns by at least 3 percent, though yearly returns have varied significantly.

Both immediately before the recession in 2007 and again in 2011, the University’s endowment made around a 25 percent return, or about 5 percent more than the national average. During the recession, the University’s endowment lost 21 percent, 3 percent more than the national average.

“During periods of economic recession, the value of the pool may even decline,” McCance said. “However, long term, the returns for U.Va. are extremely positive and certainly exceed the expectation of returns in excess of the University’s spending rate plus inflation.”