This month’s vote by the University’s Board of Visitors to reauthorize a modified version of the touted AccessUVa program has renewed a debate about the University’s obligation to promote socioeconomic diversity amid deepening cuts in federal and state funding of public universities.

A History of Changes

AccessUVa was initiated in February 2004 under then-University President John Casteen. One of the program’s key tenets was to “eliminate all need-based loans for students whose family incomes are at or below 150 percent of the poverty level, and replace these loans with grants (not work-study).”

In the intervening years between AccessUVa’s inception and the Board’s most recent revision, the program was changed to encompass families at or below 200 percent of the poverty level and work study aid.

The modified AccessUVa proposal was presented to the Board on Friday, Aug. 2 by Pat Hogan, the University’s chief operating officer. The Board discussed the presentation Friday and decided to continue the discussion Saturday morning.

Hogan said during the Saturday morning session that studies were done by consultants to determine where the University could defray increasing costs of the program. After considering different scenarios, he said, the administration determined cuts to AccessUVa grant aid would make the lowest impact in terms of the number of students and dollars going to students.

A report by consulting firm Art & Science Group conducted during the 2011-12 academic year and presented to the Board in May, however, suggest that cuts to grant aid would have a larger impact than increases in tuition.

“U.Va. could raise price [of tuition] significantly in-state and moderately out-of-state without losing market share,“ the report said. “If U.Va. were to decrease financial aid significantly, it would experience significant declines in the quality and diversity of its matriculating students, especially from out of state.”

During the Board’s discussion, Board member John Nau III said AccessUVa’s trajectory is “unsustainable” and cuts to grant aid were “the best business decision to try to stabilize AccessUVa. It’s more of a business than a philosophical approach.”

Only two of the 16 members voted against the proposal, former Rector Helen Dragas and Kevin Fay.

Who Gets the Money?

The University determines financial aid by reviewing student and family information provided on both the FAFSA and CSS profile. It organizes financial need by utilizing three general cohorts, based on the federal poverty level.

“Low income families have been defined as those at or below 200 percent of the federal poverty guidelines,” said Steve Kimata, assistant vice president for student financial services. “For this year that equated to $46,100 for [a] family of four,” said Steve Kimata.

Kimata said there is no one definition of middle income, but the University defines middle income as between 200 percent and 400 percent of poverty – between $46,100 and $92,200.

Low income Virginians currently receive a work study award of $3,000 and the remainder of need in grants. Low income non-Virginians receive a work study award of $4,000 and the remainder of need in grants, Kimata said.

That will change for students enrolling at the University for the 2017-18 school year, when the University will require all financial aid recipients to take out loans, capped at $14,000 for in-state students and $28,000 for out-of-state students.

“These numbers compare favorably with national debt averages,” Hogan said. “This is not at all in our view impacting access to the University. A student will never be admitted and then denied for financial reasons.”

A Personal Impact:

But for former student Eugene Resnick, a 2010 University alumnus and AccessUVa recipient, the new loan requirement is troubling.

“It really upsets me,” Resnick said. “A lot of us worked so hard to change things at U.Va., to move it forward. And now it seems like we’re going back again.”

Resnick, the son of immigrant parents, entered the University with a package of institutional grant and work study aid – no loans. He said the financial aid award he received from the University bested awards from other top-tier schools. Because of his aid package, Resnick was able to enroll, study abroad and graduate debt-free in four years.

The AccessUVa program, Resnick said, counteracts the advantages many affluent students at the University benefit from.

“The reality is that in my experience, students at U.Va. who come from comfortable backgrounds and whose parents work in a variety of sectors, they have the connections,” he said. “It makes a difference when they have all of that stuff and the students in the AccessUVa program don’t. My parents aren’t connected to anything. I had to build my way by myself.”

Resnick graduated with a master’s degree from the London School of Economics and now works in the public relations sector.

Future Savings, Diversity Decrease:

The new loan requirement is projected to save the University $6 million a year by 2018, according to a University press release.

Hogan said the changes were ultimately necessary because the program was growing too quickly. During the 2012-13 school year, 2,953 students – 20 percent of the undergraduate population – received institutional grant aid, Kimata said.

“Less than 25 percent of our students were in this program when it started, and now we are at 33.34 percent and rising,” Hogan said. “One-third of our student body is covered under AccessUVa in some sense or another.”

The University’s commitment to need-blind admission will continue, Hogan’s Chief of Staff Megan Lowe said. “That’s what we mean by need blind: when you are considered for admission your finances are not the criteria for admission,” she said.

The loans will also be need-based, not credit-based, she said, and most will be paid off during a period of 10 years with a typical repayment of about $200 per month.

But just by switching to a loan program, the University is substantively altering the character of AccessUVa, said Brendan Wynn, a fourth-year College student and member of the University’s Financial Aid Committee. Wynn cited the grant program as a potential factor of low-income students’ success at the University, noting their high retention and graduation rates compared to middle and high-income students.

“Because U.Va. makes the commitment to low-income students in providing them with full grant aid, in return low-income students make the commitment to U.Va. to finish,” Wynn said. “Meeting need by offering large loan packages is qualitatively different than meeting need with an institutional investment.”

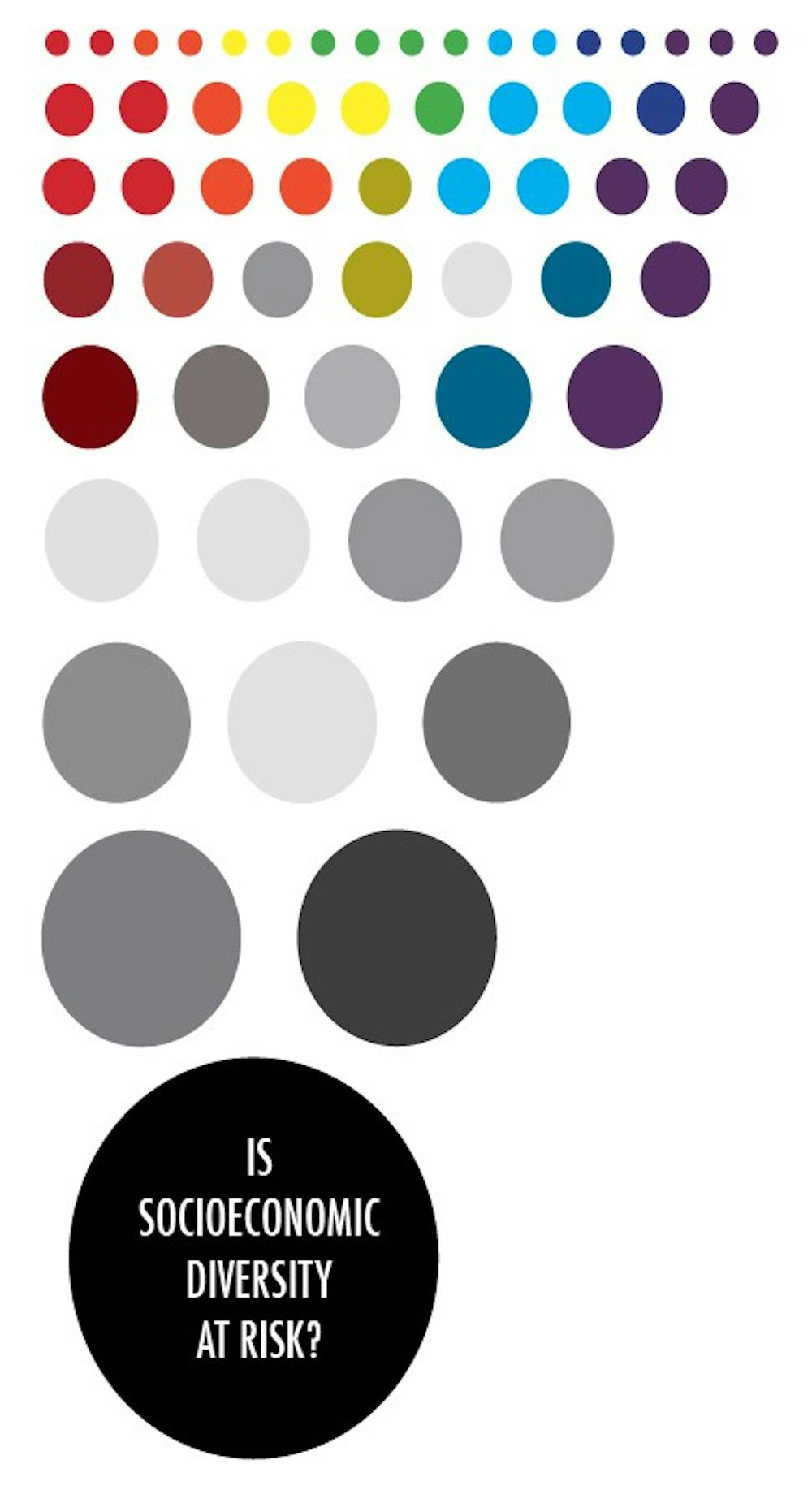

Wynn advocated the Art & Science Group proposal and raising tuition, though he noted it might discourage some lower income students from attending because of the sticker price, even with a strong financial aid program. Cutting grant aid, he said, would ultimately decrease the student body’s socioeconomic diversity.

Wynn noted, however, that budget cuts have put intense pressure on financial aid programs in recent years.

“These [cost-saving] measures are the result of an overall decrease in state and federal funding relative to institutional costs,” Wynn said.

Other state schools have recently enacted comprehensive tuition measures to combat dwindling funding. The College of William & Mary announced a new operating model in April which includes a four-year tuition guarantee, reduction in net tuition paid by middle-class families, a cap on annual tuition increases and an increase in faculty compensation.

Hogan noted during the Board discussions that the modifications to AccessUVa are part of a holistic model that includes tuition, financial aid and other components.

Kelly Kaler contributed to this article