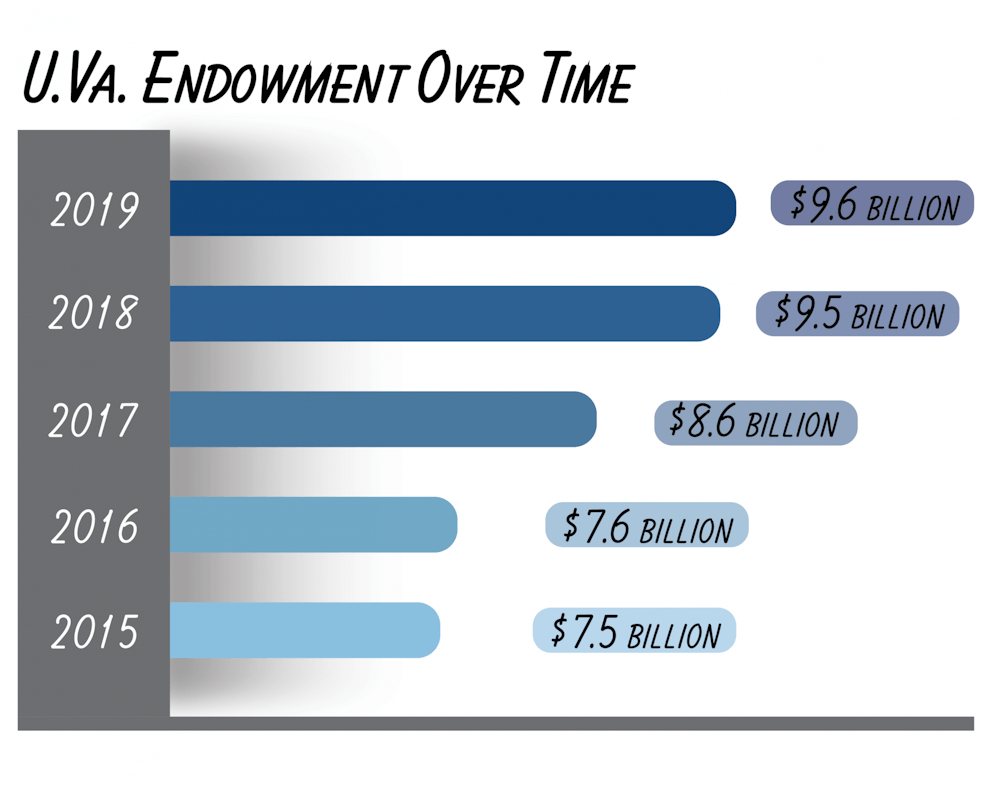

At the end of the 2019 fiscal year this past June, the University posted their endowment value at $9.6 billion — a figure that has grown about 1 percent since its $9.5 billion evaluation at the end of the 2018 fiscal year. Despite slower growth in the last year, the University consistently places in the top five of highest endowed public universities — ranking third in 2016 behind the University of Michigan at Ann Arbor and Texas A&M University at College Station according to Business Insider.

University endowments consist of monetary contributions and financial assets provided by donors. The endowment is invested in order to grow the principal and provide a rate of return that will ensure that a university has a reliable source of income for future investing and expenditures. At the University, this investment process is regulated by careful strategy under the University of Virginia Investment Management Company. UVIMCO provides investment services to the University by investing the endowment and other long-term assets in the Long-Term Pool.

Historically, this fund relied on appropriations from the commonwealth, but in recent years the University has witnessed a steady decline in state support — dropping from around 35 percent of the endowment fund in 1990 to just under 10 percent in 2019. This has compelled the University to rely on past and continued donor contributions to maintain financial security.

Outside of direct donations, the endowment also grows through University-led initiatives. University President Jim Ryan’s “Honor the Future” campaign that launched Oct. 12, has already raised $2.75 billion of its $5 billion dollar goal. This plan allows donors to choose which areas of the initiative will be funded — including scholarships, endowed professorships and financial aid.

The University’s endowment evaluation of $9.6 billion is derived from a group of investment funds known as the Long-Term Pool — with the endowment making up the largest portion at 53 percent. The Strategic Investment Fund, which serves as a source of funding for initiatives that have the potential to transform a critical area of knowledge or operation, is responsible for 23 percent of the Long-Term Pool.

In the 2018-2019 fiscal year, the Board of Visitors approved SIF projects that include investments in the Biocomplexity Institute, the Memorial for Enslaved Laborers and the Bicentennial Scholars Fund.

The last portion of the Long Term Pool is comprised of investments in University-Associated Organizations at 22 percent and University Long-Term Assets at 2 percent.

In recent years, the University has witnessed a period of growth in the market value of the Long Term Pool from 7.5 billion in 2015 to 9.6 billion at the end of the 2019 fiscal year — according to the annual report published by UVIMCO. Additionally, the Long Term Pool generated an annualized return of 11 percent over the 10-year period ending June 30th — exceeding the 9.2 percent return for the policy portfolio.

UVIMCO investment strategy is based on maximizing the University’s return objectives and risk tolerance — and above all focusing on long-term goals. UVICMO’s primary competitive edge is its aim to maintain a long-term view in all market conditions and avoid overreacting to short-term market dislocations. Although economists point toward a recession in the near future, Robert Durden — UVIMCO chief executive officer and chief information officer — affirms the financial security of the University.

“Although we anticipate the market environment will remain challenging, we will continue to follow our long-term investment philosophy and consistent investment process,” Durden said in the 2019 annual report. “Our ability to maintain a long-term view in all market conditions allows both UVIMCO and our external investment managers to use valuation and volatility to our collective advantage, and to capitalize on market inefficiencies and risk premia that arise from other investors’ focus on short-term market movements.”

While the principal of the endowment itself cannot be spent, a percentage of its returns are used to advance the University's immediate goals.

Of the money returned on these investments, the University often uses about five percent for scholarships, fellowships and professorships — equating to around $238 million this year, according to University Spokesperson Brian Coy.

“Of the money that the University does spend from endowment investment proceeds, approximately 80 percent is designated by donors for a specific purpose,” Coy said. “This income cannot be spent on any activities that aren’t outlined in the donor agreements.”

The remaining 20 percent of the income from endowed funds is used to meet emerging needs and highest strategic priorities. The University’s current capital campaign goals are focused on the top priority needs for additional philanthropy — such as funding scholarships, lectureships, research funds and book funds.

According to the 2019 annual report, unrestricted contributions are used to provide student aid, enhance teaching and research, build and maintain library collections and support student organizations and publications. The endowment also acts as a key agent in supporting students and faculty by generating a reliable stream of income for supporting merit-based scholarships and faculty grants through the Jefferson Scholar Foundation — virtually all gifts given to the Foundation are invested with UVIMCO. By using the endowment, a more dependable stream of income is created when contrasted to the volatility of using annual revenues such as tuition and state funds for faculty salaries.

“The University’s endowment has grown over time thanks to generous donors and careful management of funds,” Coy said. “Today’s students benefit from gifts made by previous generations of supporters.”